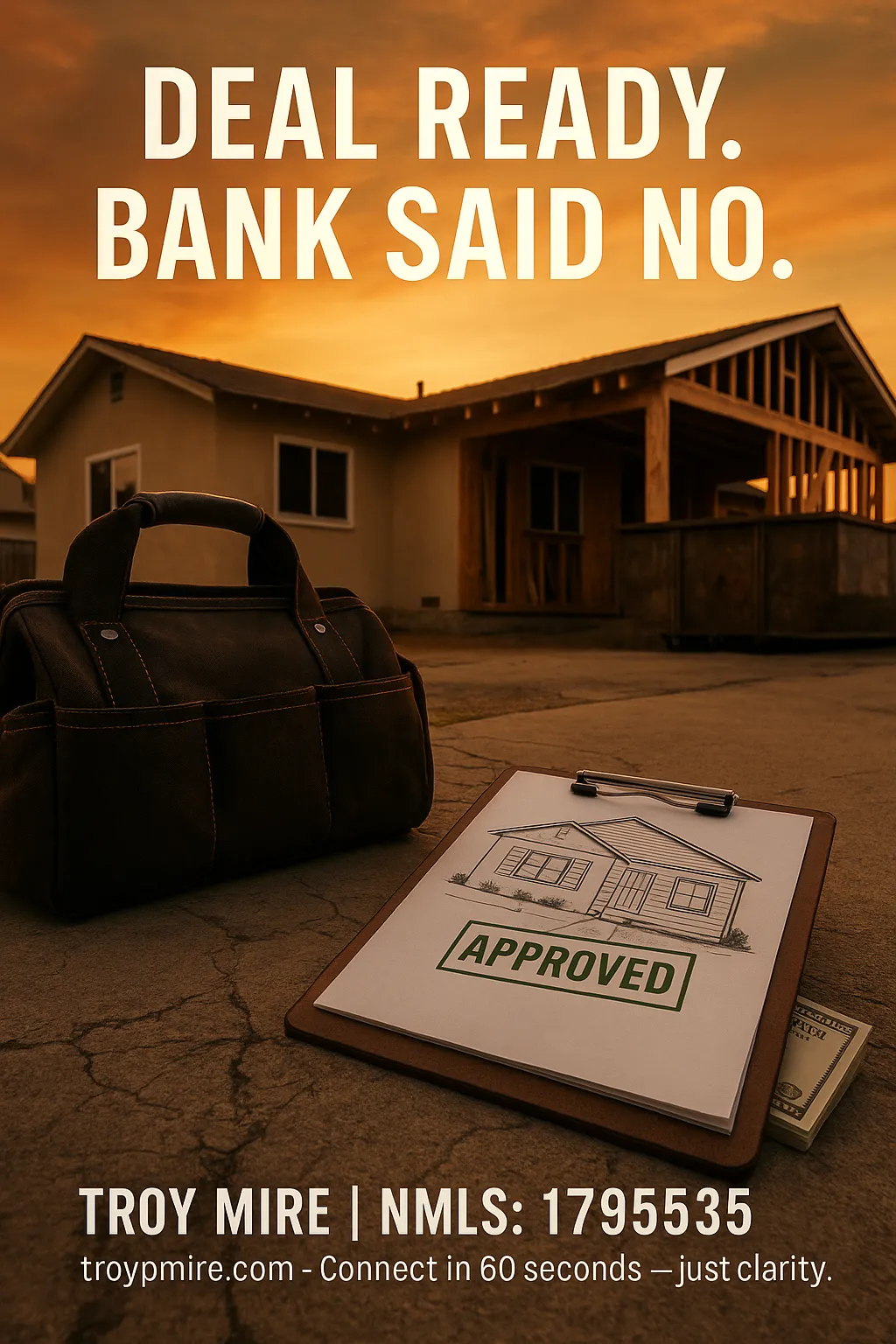

When the Bank Says No: Private Money Loans for California Investors

When the Bank Says No: How Private Money Loans Keep California Deals Moving

In today’s unpredictable lending climate, more California investors and homeowners are running into the same problem:

✅ The equity is there.

❌ But the bank still says no.

Maybe it's credit. Maybe it's income docs. Maybe it's just slow underwriting.

That’s where private money comes in.

🔹 What Is a Private Money Loan?

Private money (aka “hard money”) is a type of financing based on the property, not the paperwork. These loans are funded by private investors, not traditional banks — which means faster approvals, less red tape, and more flexibility.

If you’ve got real estate equity, we can likely get you funded — even if a conventional lender turned you down.

🏠 Real Scenarios We Just Funded:

✔ Victorville Flip – Borrower needed $240K to acquire & rehab a SFR with a 2-week close.

✔ Riverside Rental Cash-Out – Investor pulled $125K equity to buy a second property free and clear.

✔ Corona Inheritance Buyout – Heir needed $300K fast to buy out siblings — no W-2 income.

We funded these because we looked at the deal — not just the FICO score.

Why Borrowers Are Turning to Private Money in 2025:

Rates are up, but deals still pencil with the right leverage

Inventory is moving, and missing your close window can cost you

Construction delays and cost overruns need fast gap capital

Inheritance and divorce buyouts require speed, not excuses

💡 If You're Sitting on Equity, You're Sitting on Options

Whether you're trying to close fast, restructure debt, or leverage equity for your next move — talk to us first.

No one-size-fits-all. No assumptions. Just a straight answer on what’s possible and how fast.

⚡ “Connect in 60 seconds — no commitment, just clarity.”

We’ll review your deal and let you know if we can fund it — fast.